10 Simple Steps to Buying a Home

By Mike Shenouda, Designated Managing Broker

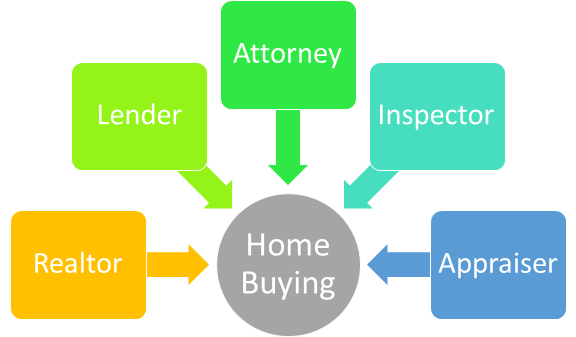

Navigating through the maze of home buying can be overwhelming, especially as a first-time buyer. What in the what is earnest money? What is the importance of getting pre-approved? With the assistance of a great team, we can make the home buying process a breeze. There are typically a couple of key players to ease the home buying process; a mortgage broker, a Realtor, and an attorney. Throughout the process, you will also work with a home inspector and an appraiser. Here are the major steps to home buying:

-

Contact a mortgage broker and get pre-approved. Your mortgage broker will help identify if there are any areas of improvement that would help lower your interest rate or increase your spending power, such as paying down a credit card or improving your credit score. Your mortgage broker will be a KEY player throughout the process by getting you approved for a loan.

-

Contact a Realtor. Your Realtor will help coordinate, educate, provide expertise and help negotiate the best possible price. Your Realtor will serve as your confidant throughout the home buying process.

-

Create a home buying wish list. Break your list down to your non-negotiables and items that would be nice to have, but could live without. Your Realtor will help you fine-tune your wish list as well.

-

Select your desired area and begin looking at homes. After viewing a few homes and getting a feel for your tastes, your Realtor should be able to keep an eye out for the perfect property for you.

-

Make an offer. Once you find your dream home, put in an offer with the assistance of your Realtor.

-

Contact a real estate attorney. Your attorney will play a key role in the home buying process following offer acceptance.

-

Contact a home inspector. The home inspector will do a thorough inspection of your home and will provide you with a detailed report.

-

Get home appraised. If agreement is reached following your home inspection and attorney review, your mortgage broker will schedule an appraisal. The appraiser will determine the value of your future home.

-

Complete a final walk through. The day before or the day of closing, you will walk through the property to verify there have been no changes in the home and any requested repairs have been made.

-

Closing day! On average, from offer acceptance to close, it takes about 45 days to close. Once all of the above steps are completed, you will close on your home. This typically takes about 2-3 hours and is the final step towards home ownership. Typically closing will be held at a title company or an attorney’s office.

Please call 312.600.4507 for a complimentary home buying consultation.